News

Stay informed with the latest updates from Ward Goodman. From financial services and tax insights to business accounting updates and employee news, this page keeps you up to date with what matters to you and your business.

Asset Allocation Demystified

Successful investing is not about picking the “best” fund. It is about how your investments are structured.

Asset allocation (how you spread money across different types of investments) has a major influence on long-term outcomes and risk levels.

In simple terms:

• Equities → Long-term growth, but more ups and downs

• Bonds → Stability and income

• Cash → Capital preservation and easy access

• Alternatives → Added diversification and inflation protection

The right mix helps:

• Manage market volatility

• Reduce reliance on any one investment

• Keep risk aligned with personal goals

• Deliver more consistent long-term performance

Asset allocation should reflect your risk tolerance, time horizon and financial objectives. Regular reviews and rebalancing help keep your portfolio on track as markets and circumstances change.

At Ward Goodman, we help clients build portfolios where every element plays a role, balancing growth opportunities with thoughtful risk management.

https://www.wardgoodman.co.uk/blog/asset-allocation-explained/

#InvestmentPlanning #AssetAllocation #WealthManagement #RiskManagement #Diversification

Small Employers Relief Increase

HMRC has confirmed that Small Employers’ Relief will be increased for the 2026/27 tax year. From 6 April 2026, qualifying employers will be able to reclaim 100% of certain statutory payments plus 9% compensation where total Class 1 National Insurance contributions in the previous tax year were below £45,000.

This applies to statutory maternity, paternity, adoption, shared parental, parental bereavement and neonatal care pay. The eligibility threshold remains unchanged.

For small employers, this increase improves cashflow support when managing statutory pay obligations and is a positive development for payroll planning in the year ahead.

#HMRC #Payroll #SmallBusiness #StatutoryPayments #UKTax #PayrollProfessionals

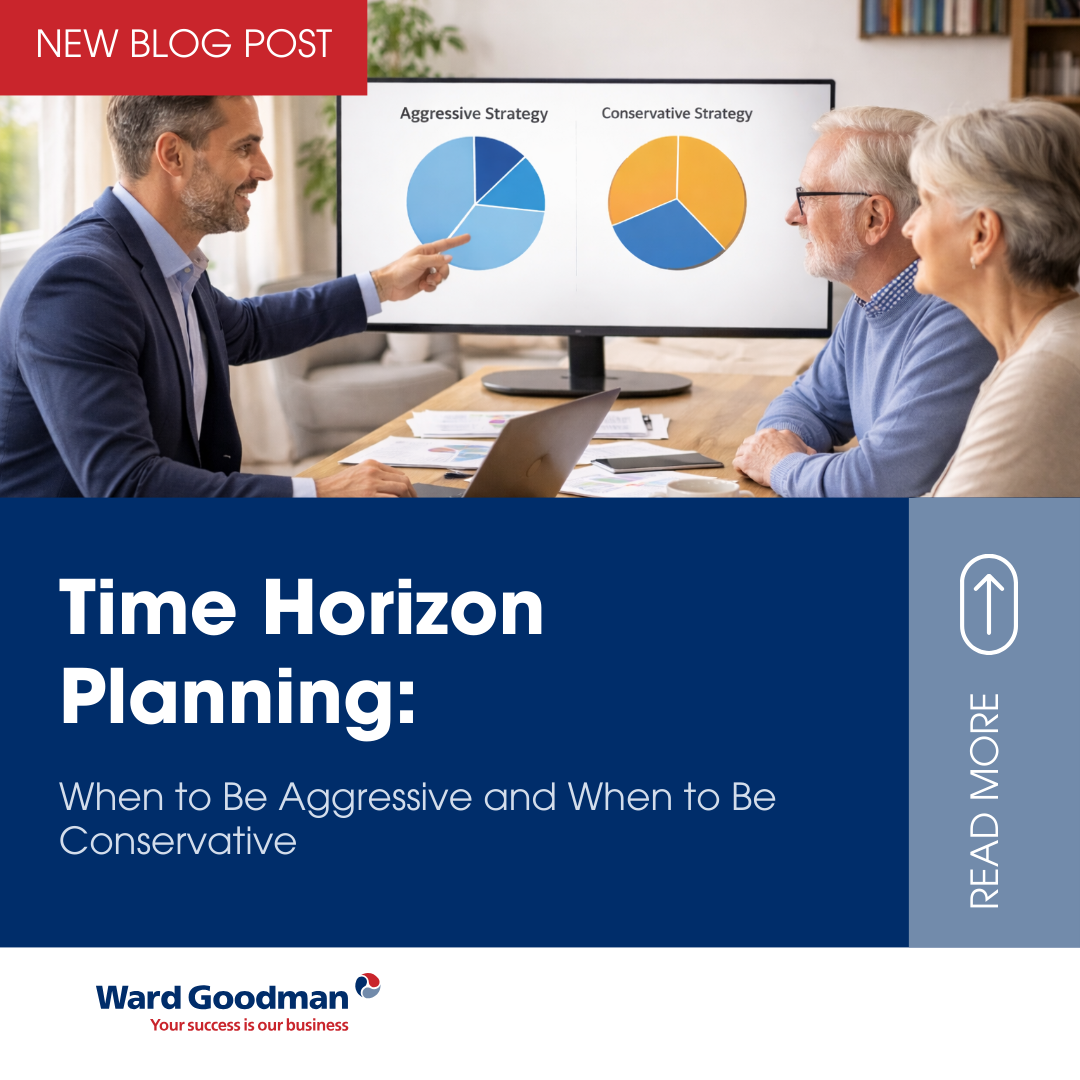

Time Investment Planning

Investment success is not about reacting to headlines. It is about understanding time.

Your investment time horizon (how long you have before you need access to your money) is a key factor in deciding how much risk may be appropriate.

In simple terms:

• Longer time horizon → Greater ability to focus on growth

• Shorter time horizon → Greater need for stability and capital protection

• As goals get closer → Strategy should gradually reduce risk, not change suddenly

Good planning also considers risk tolerance, income needs and personal circumstances. A structured approach helps investors stay disciplined through market ups and downs while keeping long-term objectives at the centre of decisions.

At Ward Goodman, we help clients ensure their investment strategy stays aligned with both their future goals and their timeline. https://www.wardgoodman.co.uk/blog/time-horizon-planning/

#InvestmentPlanning #FinancialPlanning #WealthManagement #RiskManagement #LongTermPlanning

HMRC update on changes to some annual tax coding

HMRC has confirmed that some 2026 to 2027 tax codes will be adjusted following a review of coded allowances. This includes the removal of certain employment expenses and higher rate Gift Aid relief entries where records indicate they may no longer reflect a taxpayer’s current position, particularly where there is no recent Self Assessment activity or supporting evidence.

These changes are likely to prompt questions from employees who see differences in their tax code or take home pay. It is a timely reminder of the importance of reviewing coding notices and ensuring reliefs claimed through PAYE remain accurate and up to date.

#HMRC #TaxCodes #Payroll #UKTax #TaxCompliance #PayrollProfessionals

🎥 Now on YouTube: Get to know Ward Goodman

Our YouTube channel is growing, with short, bite-sized videos designed to give you a real insight into who we are and how we support our clients.

What you will find:

✨ Employee Shorts – meet the people behind Ward Goodman

✨ Ward Goodman introductions – learn about our values and how we work

✨ Financial services insights – practical guidance across tax, pensions, and financial planning

Whether you are considering working with us, joining the team, or simply want clear financial guidance, our videos are a great place to start.

Subscribe to the Ward Goodman YouTube channel and explore our latest Shorts and videos today.

https://www.youtube.com/@WardGoodmanGroup/

Updated Starter Checklist from April 2026

Updated Starter Checklist from April 2026

A newly updated Starter Checklist for employees has been published, and payroll teams should be ready to use it from April 2026.

This checklist helps employers confirm the correct tax and payroll setup when someone starts work, reducing errors and ensuring compliance with HMRC requirements.

Make sure your onboarding and payroll processes reflect the latest guidance so new starters are processed accurately from day one.

#Payroll #StarterChecklist #WardGoodman #PayrollSpecialists

Book a Meeting

If you would like to discuss further, please book a meeting with an experienced member of our team. Simply let us know when’s best for you and we will get in touch to arrange a suitable time.